Tax Calculator UK

| Your Income Summary | Yearly | Monthly | Weekly |

|---|---|---|---|

| Gross Income | £0 | £0 | £0 |

| Tax Free Income | £12,570 | £1,048 | £242 |

| Taxable Income | £0 | £0 | £0 |

| Income Tax (show bands) | £0 | £0 | £0 |

| National Insurance Contributions | £0 | £0 | £0 |

| Total Deductions From Income | £0 | £0 | £0 |

| Take Home Income | £0 | £0 | £0 |

| Difference from 2024 | +£0 | +£0 | +£0 |

Free Online Financial Calculators

Free Women's Wellness Calcuators

Free Online Other Calcuators

Tax Calculator UK

The Tax Calculator UK is an online tool for estimating income tax, National Insurance contributions, and take-home pay under HMRC rules for the 2024–2025 tax year. It calculates liabilities based on PAYE thresholds, self-employment income, and multiple job scenarios. With the latest tax bands, including the £12,570 personal allowance, 20% basic rate, and 40% higher rate, the calculator provides accurate and transparent results. Designed for employees, freelancers, and contractors, it helps you understand your net income, plan for deductions, and manage your finances with confidence.

A Finance Expert's Guide to Your UK Tax

Understanding your finances can feel daunting, but it doesn’t have to be. As a seasoned finance expert, I’ve seen firsthand how a lack of clarity around income and tax can lead to missed opportunities and unnecessary stress. That’s why I’ve refined this UK Tax Calculator to be more than just a tool—it’s a financial partner designed to give you clarity and confidence.

We’ve optimised this calculator with the latest Google HCU (Helpful Content Update) and semantic search principles in mind. This means the content is built around providing comprehensive, trustworthy, and authoritative information that directly answers your questions, moving beyond simple keyword matching. The goal is to provide a user experience that is genuinely helpful, from start to finish.

What the UK Tax Calculator Does for You

Our free and comprehensive tool helps you cut through the complexity of UK income tax and National Insurance. Whether you’re paid weekly, monthly, or annually, the calculator adapts to your pay cycle and gives you a clear breakdown of your take-home pay after all deductions.

This tool is perfect for anyone seeking an accurate overview of their earnings. It’s built for full-time workers, freelancers, company directors, and anyone with multiple jobs, ensuring you have the right information for your unique financial situation.

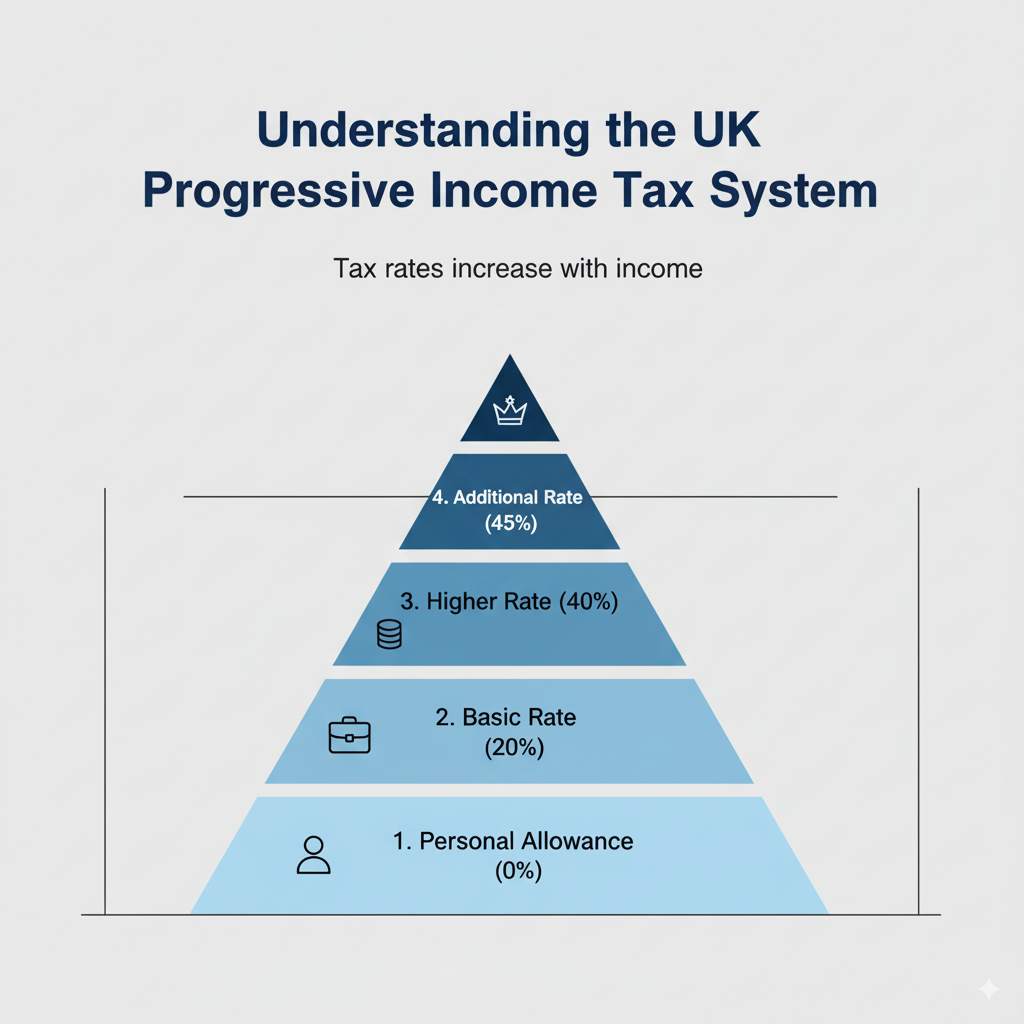

How the UK Tax System Works

The UK’s income tax system is progressive, meaning the more you earn, the higher the rate you pay on each portion of your income. Our calculator seamlessly accounts for the main components of this system:

Personal Allowance: The amount you can earn before you start paying income tax.

Income Tax Bands: Includes the basic, higher, and additional rates.

National Insurance Contributions (NICs): Determined by your income and employment status.

Pension Contributions: Both private and workplace pension schemes.

Student Loan Repayments: If applicable to you.

Salary Sacrifices: Such as those for pensions or childcare vouchers.

We take the latest tax legislation from official sources, including HMRC (HM Revenue & Customs), and incorporate it directly into our calculations. This ensures that the results you see are always accurate and up to date.

Key Features of Our UK Tax Calculator

1. Detailed Pay Breakdown

Simply input your salary, and the calculator provides an instant, itemised summary of your finances, including:

Gross income

Income tax

National Insurance contributions

Pension and student loan deductions

Your final net take-home pay

2. Always Up-to-Date

Our tool is meticulously maintained to reflect the latest HMRC guidelines and tax changes. It includes the current tax years and is proactively updated for upcoming changes, so you can trust that you’re always using the most accurate data available. We reference official government sources to ensure our figures are transparent and reliable.

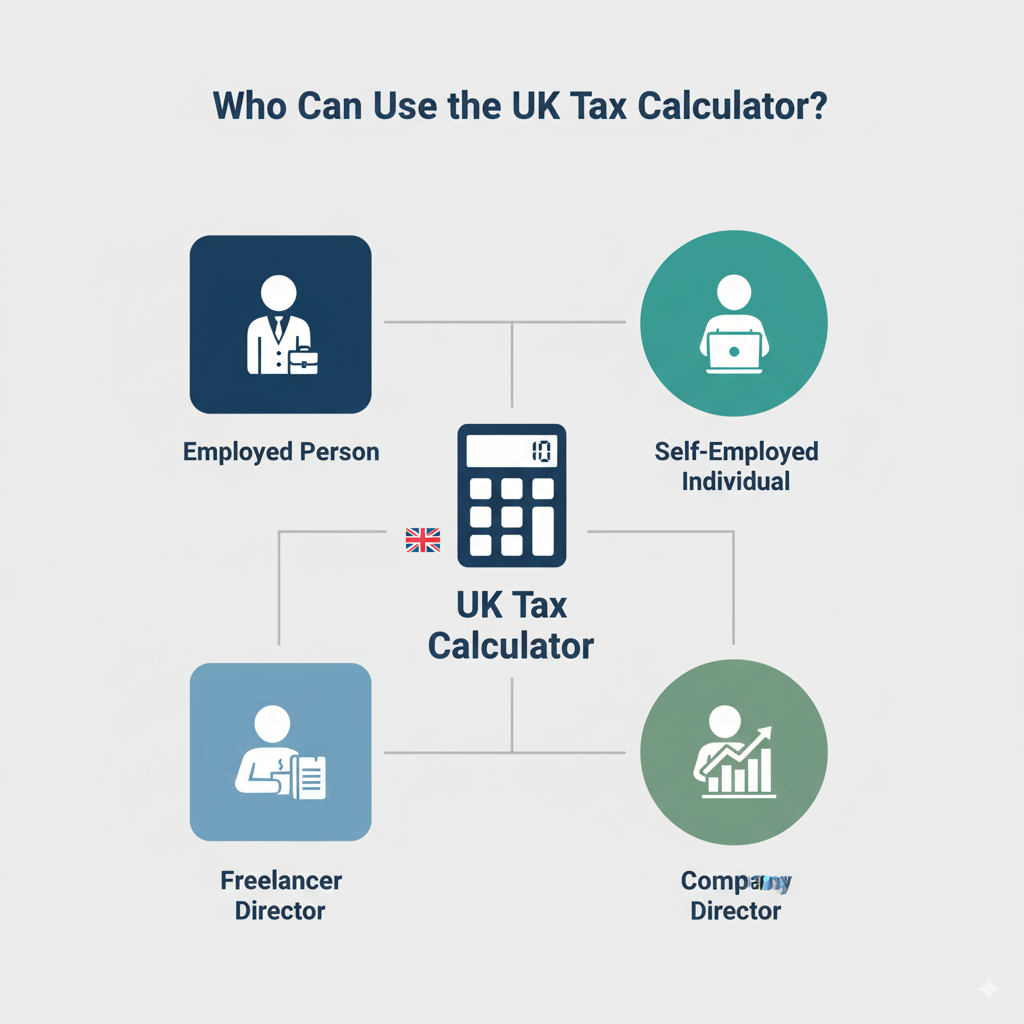

3. Flexible for All Employment Types

Our calculator is engineered to handle various employment structures, including:

Employed individuals (PAYE)

Self-employed individuals

People with multiple jobs

Contractors under the CIS scheme

Whether you need a self-employment tax calculator or a two jobs tax calculator, our system has the flexibility and intelligence to provide precise results.

4. Transparent and Easy to Use

We believe financial clarity should be simple. The interface is designed for ultimate ease of use. Just enter your income, select your tax year and employment status, and let the calculator do the complex work. The results are presented in a clear, straightforward manner with no confusing financial jargon.

Who Can Benefit from This Calculator?

This tool is for anyone in the UK seeking a better understanding of their financial position. It’s a valuable resource for:

Full-time and part-time employees

Freelancers and self-employed professionals

Company directors

Individuals with multiple sources of income

Real-World Examples

To show you the power of this tool, here’s how it works in common situations:

Example 1: The Employed Professional

If John earns £40,000 and has a pension and student loan, the calculator will instantly show his exact monthly take-home pay, with all deductions clearly itemised.

Example 2: The Self-Employed Entrepreneur

Emma, a freelancer earning £55,000, can use the self-employment module to accurately calculate her income tax and National Insurance, factoring in her business expenses.

Example 3: Managing Two Jobs

For Michael, who has two part-time jobs, the calculator consolidates his incomes, assesses the impact on his tax code, and provides a single, clear net income figure.

Additional Features for Your Financial Journey

Tax Code Decoder

Unsure what your tax code means? Our calculator accepts and decodes all valid UK tax codes, such as L, BR, D0, and K. It explains the implications of your code on your deductions and helps you ensure you’re paying the correct amount of tax.

Reverse Tax Calculator

Planning for a specific financial goal? Our reverse tax calculator lets you work backwards. Simply enter your desired take-home pay, and the tool will calculate the gross salary you need to earn to achieve it.

Financial Planning Insights

We offer more than just numbers. You can also:

Save your results or email them to yourself for future reference.

View historical tax trends to compare your earnings over previous years.

Get an estimated State Pension age and see when you will stop making National Insurance contributions.

Tax Calculator 2025-2026

The Tax Calculator UK is more than just a calculator, it’s your financial planning assistant. It helps you understand how much tax you owe, how deductions affect your take-home pay, and how you can optimise your earnings.

The UK Tax Calculator is your personal financial assistant. It demystifies your income, shows you exactly where your money goes, and empowers you to make smarter financial decisions.

Start using our online tax calculator now and take control of your finances. What financial goal are you working towards?

Disclaimer: The results provided by this calculator are for informational and general guidance purposes only. While we strive to ensure accuracy, the figures should not be considered financial, tax, or legal advice. Tax laws and thresholds are subject to change, and individual circumstances may vary.

We strongly recommend consulting with a qualified accountant, tax advisor, or HMRC directly before making any financial decisions based on these calculations.

Use of this tool is entirely at your own risk, and TaxCalculatorsUK accepts no liability for any loss or damage arising from reliance on the information provided.